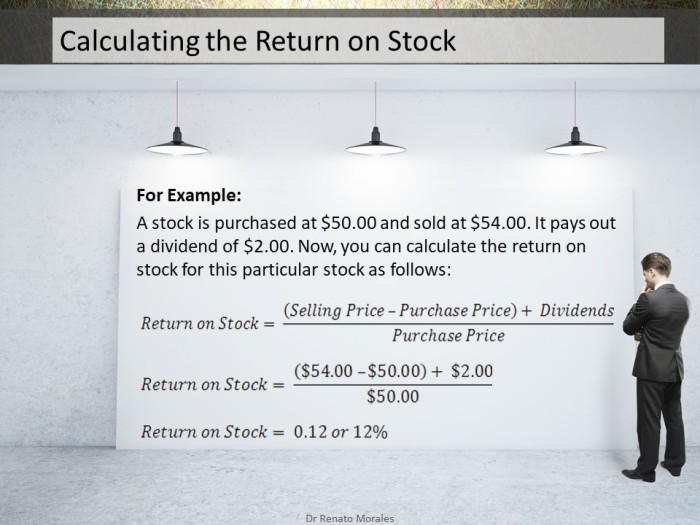

As an investor or stockholder, you can earn a return from a particular stock through a dividend or increases in the stock’s price. So, you can calculate the return on stock that you receive over a given period of time, by the following:

For Example: A stock is purchased at $50.00 and sold at $54.00. It pays out a dividend of $2.00. Now, you can calculate the return on stock for this particular stock as follows:

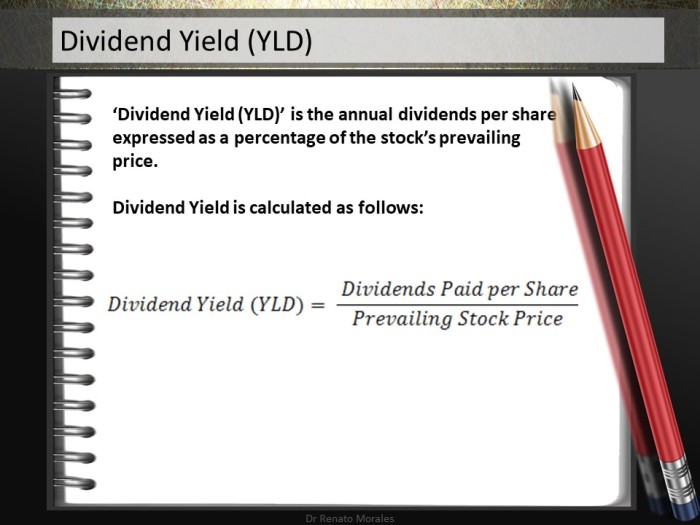

- Dividend Yield = ‘Dividend Yield (YLD)’ is the annual dividends per share expressed as a percentage of the stock’s prevailing price. Dividend Yield is calculated as follows:

For Example: A stock has a prevailing stock price of $100.00. It pays out an annual dividend of $5.00 per share. Now, you can calculate the Dividend Yield (YLD) for this particular stock as follows:

Price Earning Ratio (P/E)

The stock’s Price-Earnings (PE) ratio is shown in almost all stock quotations. Price-Earnings (PE) ratio represents the company’s prevailing stock price per share divided by the firm’s earning per share. The PE Ratio is usually closely monitored by many investors. It is believed that a low PE ratio relative to other companies in the same industry shows that the prevailing stock price is too low, based on its earnings. Therefore, such a stock may be perceived as undervalued and considered a good buy.

Price-Earnings (PE) ratio is calculated as follows:

[…] Calculating the Return on Stocks […]

LikeLike